Escaping the Debt Doom Loop: Unlocking $454 Billion for V20 Countries

June 30, 2025—The Third Edition of the V20 Debt Review reveals that V20 countries would have been 20% wealthier today in terms of GDP had it not been for climate change. Delaying investment in climate action risks shutting the door on future economic opportunities for climate-vulnerable countries to grow, transition toward climate resilience, and prosper.

According to the latest V20 Debt Review and the Bridgetown Initiative, V20 countries will require USD 490 billion in climate finance by 2030 to address the escalating consequences of climate shocks—challenges that are compounded by shrinking fiscal space. Worsening climate impacts, rising adaptation costs, and shifting political dynamics—such as the US withdrawal from the Paris Agreement—have made accessing affordable finance far more difficult.

Key challenges cover:

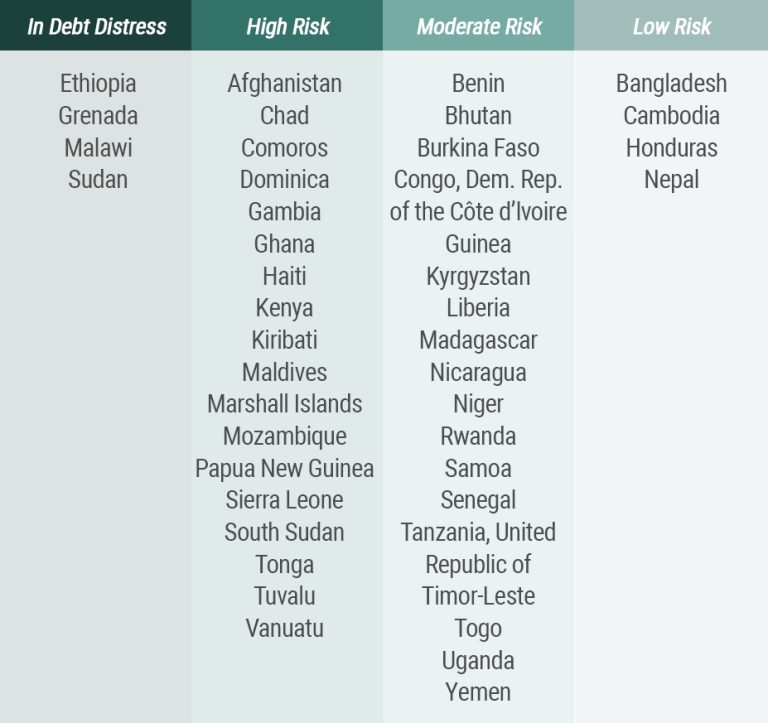

- 22 out of 45 V20 countries that have high risk ratings are rated by the World Bank and the International Monetary Fund (IMF) as being in debt distress or at a risk of debt distress. (Figure 1)

- V20 countries that are middle-income countries face high costs of borrowing.

- V20 countries are forced to mobilize finances in the context of dwindling Official Development Assistance.

In 2023, the total sovereign debt stock of V20 countries reached USD 1.01 trillion, equivalent to 25% of members’ Gross National Income (GNI). Eleven countries spend more than 25% of their government revenue on debt service alone. External debt service payments tripled over the past decade, rising from USD 47 billion in 2014 to USD 131 billion in 2024. V20 countries now spend four times more servicing debt compared to climate investments.

A breakdown of the composition of the external debt stock conducted in the report revealed that Multilateral Development Banks (MDBs) are the largest creditors class—at 40%—followed by private creditors at 32% and Paris Club bilateral creditors at 10%. Despite surging climate costs, ODA levels have declined relative to GNI, while debt vulnerabilities keep growing, further shrinking the fiscal space urgently needed for climate resilience and recovery.

To break this doom loop, the latest V20 Debt Review proposes extending repayment periods to 40 years at an interest rate of 1.35%, which is consistent with the International Development Association’s (IDA) rate. This reprofiling could reduce debt obligations between 2025 and 2031 to USD 293 billion, saving V20 members USD 454 billion compared to current schedules—a vital step to free up resources for climate action and economic stability.

The recently concluded Fourth International Conference on Financing for Development (FfD4) in Seville, Spain, was a critical moment to advance needed reforms to the global debt architecture, ensure inclusive negotiations, and hold creditors—such as MDBs—accountable. Looking ahead, V20 countries will continue to push for timely, comprehensive debt relief and meaningful progress on commitments under the SDGs and the Paris Agreement. Equally important is the Baku to Belém Roadmap, which is a critical opportunity to bring debt solutions to the forefront of climate discussions.

***