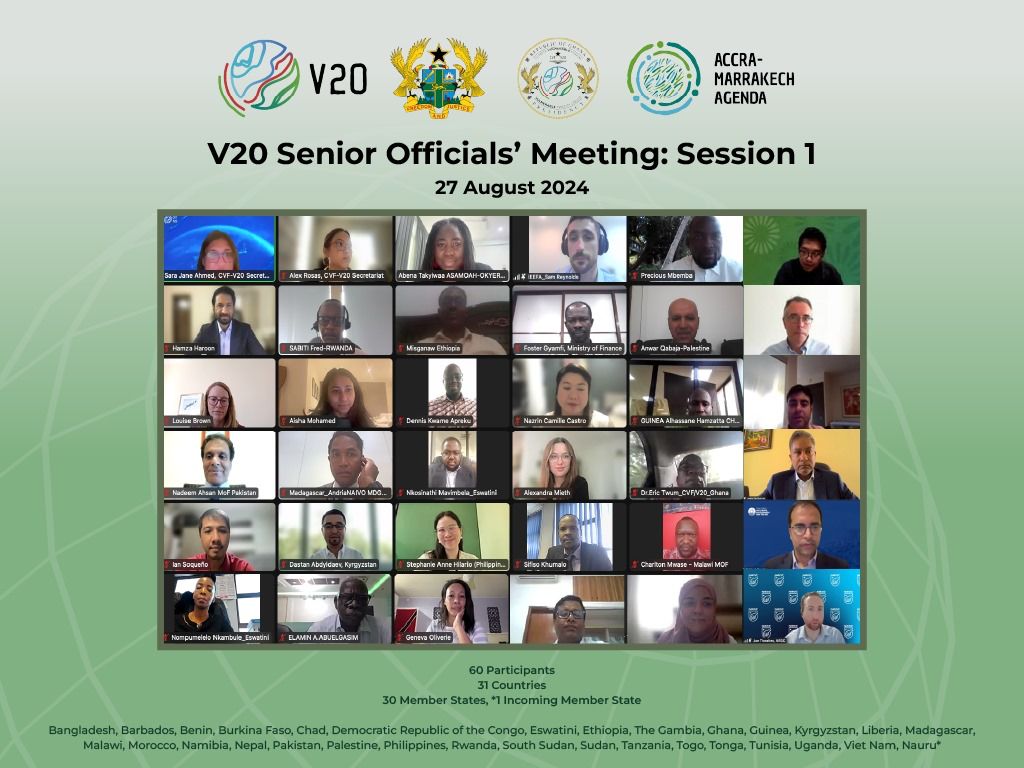

28th August 2024, ACCRA: The V20 Group of Finance Ministers held its Senior Officials’ Meeting (SOM) on 27th and 28th of August, to discuss the financing initiatives of the Climate Vulnerable Forum (CVF) and V20. This meeting was held in preparation for the upcoming V20 Ministerial Dialogue which will take place during the 2024 Annual Meetings of the International Monetary Fund (IMF) and the World Bank Group (WBG).

The virtual SOM meeting discussed key milestones of the CVF-V20, the international financial architecture reform agenda, and strategic initiatives of the CVF-V20. The SOM emphasized the need for closer collaboration to drive economic transformation and expedite financial flows.

The discussions included:

- The International Financial Architecture was covered, highlighting multilateral development bank (MDB) reforms, sovereign debt restructuring, and the potential for a transformed IMF. MDB reforms are expected to mobilize $357 billion over 10 years with balance sheet optimization. Significant capital injections and concessional finance, and a new issue of Special Drawing Rights (SDRs) for climate action, however, remain urgent. Challenges faced by climate-vulnerable nations, including high cost of capital and, therefore, high debt servicing costs, were raised.

- The presentation on the upcoming CVF declaration, V20 Communique and the Bridgetown Initiative 3.0 highlighted critical priorities, focusing on several key areas where reforms are urgently needed. These included ensuring debt sustainability, addressing issues with credit rating agencies, and emphasizing the necessity for universal access to liquidity on concessional terms in the aftermath of disasters.

- The SOM also provided an update on the V20 governors working group work program on maintaining financial stability in the face of climate shocks, protecting climate-vulnerable groups, and deepening sustainable finance initiatives. The SOM highlighted financing challenges with external debt in emerging markets and developing economies hitting alarming levels, with 40 countries globally in debt distress, with limited fiscal space, increased borrowing costs, stress on exchange rates and capital inflows, and significant climate financing challenges1, contributing to worsening sovereign credit worthiness. Climate risks stemming from disproportionate exposure to physical climate risks, disorderly transition and cross-border spillover transition risks are preventing V20 countries from benefiting from transition opportunities such as: extensive renewable energy potential, major reserves of critical minerals, large natural carbon sinks, and adaptive/regenerative agriculture.

- An update on the V20 Carbon Financing partnership with the Voluntary Carbon Markets Integrity Initiative (VCMI) was provided, outlining the aim to enable carbon credit opportunities for member states, especially those pursuing Climate Prosperity Plans, through high integrity carbon market mechanisms.

V20 officials highlighted preparations required to hold several events leading up to the 13th V20 Ministerial Dialogue in Washington DC during the 2024 Annual Meetings of the International Monetary Fund (IMF) and the World Bank Group (WBG) in October 2024. These include:

- V20 will participate in the fourth G20 Sustainable Finance Working Group meeting in September in Brazil.

- During the upcoming United Nations General Assembly in September, key sessions will include a Climate Prosperity Plan Investors and Parliament session on the 20th, followed by the CVF Leaders meeting on the 25th. This meeting will feature the Ghana-to-Barbados presidency handover ceremony, the presentation of the CVF Leaders Declaration, and the discussion of the resolution to grant the CVF Observer status at the UN General Assembly, which will be considered by the Sixth Committee.

The meeting concluded with a call for member states to engage closely with the V20 Secretariat in preparation for the upcoming 13th V20 Ministerial Dialogue on 22 October 2024, from 12:30 PM to 2:00 PM at the IMF Headquarters in Washington DC.

ENDS

NOTES FOR EDITORS:

About CVF-V20

The CVF-V20 represents 68 members from small island developing states (SIDS), least developed countries (LDCs), low-to-middle income countries (LMICs) and fragile and conflict-affected states (FCS). Working together, the CVF-V20 aims to achieve climate justice through the realization of Climate Prosperity Plans, which contain ambitious economic and financial resilience strategies designed to attract investment and resources that advance the attainment of the Sustainable Development Goals, 30×30 Global Biodiversity, and help keep the average global temperatures to the Paris Agreement’s 1.5°C safety threshold.

For the latest updates on the CVF and V20, please follow us on X at: @TheCVF, @V20Group

For media enquiries, please contact Paul Roberts at [email protected] or (WhatsApp +960 7654337)

1 The $100 billion per year climate finance goal of the Paris Agreement was met – and exceeded by $15.9 billion – for the first time in 2022, two years after the deadline for the target. Though, given the current financial system is deeply flawed, diverting crucial funds from the countries that need them most to the wealthiest. The G20 Independent Expert Group published a report, highlighting that in 2023 net outflows from Emerging and Developing Countries rose by 68 billion US dollars to nearly 200 billion US dollars taken out by private creditors in interest and net repayments. Meanwhile, international financial institutions and assistance agencies extracted 40 billion US dollars, and net concessional assistance was a mere 2 billion US dollars, despite widespread famine in climate-vulnerable regions. This dire situation forces developing economies to slash essential spending on health, education, and infrastructure. Access and accountability are critical and also underscores the need to ensure fairer financial flows directed towards locally-led, national, and regional institutions.